The Board of Directors plays a central role in CTGI's corporate governance as the body vested with powers related to the strategic, organizational and control policies, and pursues the sustainable success of the same. The objective of the Board of Directors is to promote corporate/social interests representing the Company and its shareholders in the management of its assets and businesses and directing business organization. The Board has a management mechanism in place to ensure that conflicts of interest are prevented.

CTGI's Board of Directors is dedicated to promoting long-term value creation. It defines the Company's strategic objectives and annually reviews opportunities and risks, including financial, legal, operational, social and environmental risks, and the measures taken in response. It ensures that both the Company's strategy and the investment have taken climate change into consideration. To ensure the Board in carrying out its duties, a continuous training program on climate change was conducted for the Directors. It included a variety of modules on the following topics: climate change, energy transition and environmental risks, financial risks and opportunities. The Directors took part in the ESG workshops designed to raise ESG awareness, guide implementation of the Company's ESG action plan and share the ESG best practices based on their experience and background.

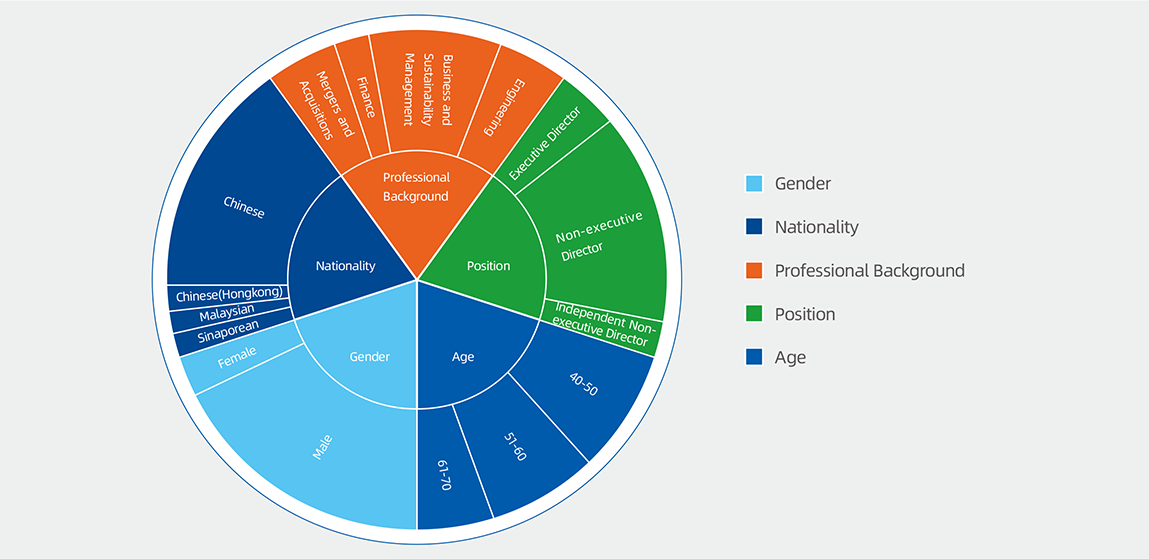

Composed of 11 professionals with diversity of knowledge, experiences, origins, nationalities and gender, whose aim is to provide real value to the Company, working every day from a position of integrity and transparency in the most efficient and effective way. CTGI keeps exploring on building a governance system that enhances the independence, diversity and effectiveness of the Board. As such, our Board consists mainly of non-executive directors, accounting for 82%.

Standing Committees of the Board

The Board of Directors has also established 4 standing Committees with the power to investigate, propose and advise, in order to ensure an adequate internal division of its functions, as well as a related parties committee. In particular, the following committees have been established:

Strategy and Investment Committee

Strategy and Investment Committee

The key responsibilities of the Strategy and Investment Committee is to analyze the Company's vision, mission, strategy, business plan, annual plan, investment plan and other important matters, to propose the project investment policy, to review investment-related issues and supervise investment risks, to conduct research on other crucial matters of the Company that may have vital impact on the Company's development, and to make recommendations to the Board. In particular, the Committee provides advice and support in defining the Company's ESG strategy and provides opinions and recommendations on the environmental and social impact of projects under the investment decision made by the Company. The Committee is composed of 9 members.

Remuneration Committee

Remuneration Committee

The Remuneration Committee is responsible for conducting research on the Company's compensation mechanism and specific policies for Directors and Management Team, and reviewing the Company's annual payroll plan, reviewing the qualification of candidates for Directors and the criteria, procedures and methods for the selection of the Company's executive members, inspecting on the candidates for the executive members and Company Secretary and making recommendations to the Board. The Committee is composed of 5 members.

Audit and Risk Management Committee

Audit and Risk Management Committee

The Audit and Risk Management Committee is mainly responsible for reviewing and monitoring the Company's risk management system, internal control system, legal compliance management system and ethics, reviewing, inspecting and assessing the internal audit of the Company, reviewing the Company's annual audit plan and important audit reports. To safeguarding good corporate governance and transparency in all the Company's economic and financial actions, this Committee is also in charge of supervising the conducts of the directors and executive members of the Company and assessing whether they conform to the requirements of applicable Laws and relevant policies of the Company as well as managing a whistleblowing reporting channel for non-compliance activities of the Company. This Committee is chaired by the independent director of the Board and composed of 4 members.

ESG and Related-party Transaction Committee

ESG and Related-party Transaction Committee

The ESG and Related-party Transaction Committee is in charge of assisting the Board of Directors on sustainability issues and the dynamics of the Company's interaction with all stakeholders, and secures corporate transparency and fair transactions. In specific, this Committee's responsibilities include conducting research on the framework of the Company's policing systems, establishing the Company's ESG management system, conducting ESG's strategy, goals, materiality matrix, policies, identifying ESG risks and opportunities and monitoring ESG system's operation, ensuring progress toward delivering on the Company's sustainability commitments as well as improving operational programs to address gaps in the Company's sustainability programs. This Committee is also responsible for reviewing related party transaction and making recommendations to the Board. This Committee is chaired by the female director of the Board and composed of 5 members.?